The benefits industry is filled with time-consuming processes that result in discrepancies, timing issues and administrative burdens. Meanwhile, consumers expect an intuitive, familiar benefits shopping experience. That’s why we’re creating the customer experience of the future through our revolutionary carrier partner program, PlanSource Boost.

Modern API

integrations

pricing

experience

billing

Modern API Integrations

Plan Configuration

Automates the setup and renewal process, eliminating errors

Available Now:

Guardian, MetLife

Member Portal

Single sign-on access to carrier portal within benefits shopping experience

Available Now:

Guardian, MetLife, Prudential

Provider Directory

Available Now:

Guardian, MetLife

Evidence of Insurability

For seamless shopping and automated decision notification

EOI SSO & Decision Notification:

Aflac, Guardian, Lincoln Financial Group, MetLife, New York Life, Prudential, Sun Life, Voya

EOI Submission & Decision Notification:

Reliance Matrix

EOI SSO Only:

Mutual of Omaha, The Hartford, The Standard, Unum

Enrollment API

Eliminates batch EDI files and related timing issues

Available Now:

Aflac, Ameritas, Guardian, MetLife, The Hartford, Unum

Modern API Integrations

Coming Soon

Preferred Pricing

*Medical is not a qualifying line of coverage

Optimized Employee Shopping

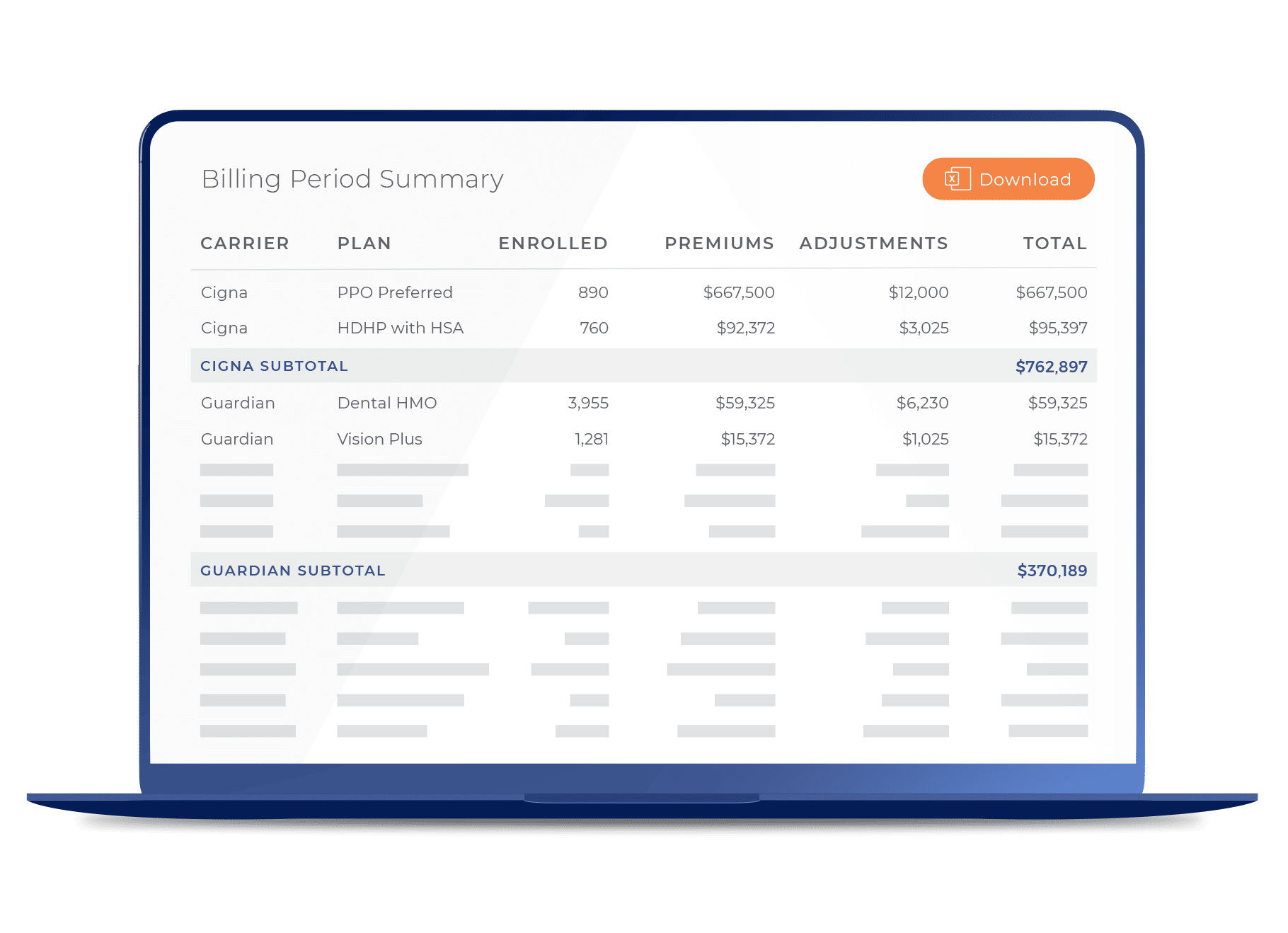

Simplified Self-Billing

With PlanSource Boost, employers no longer need to reconcile carrier-provided bills, which saves them approximately 40 hours each month.

- Boost carriers no longer need to track and send bills to customers

- PlanSource collects premium from customers and pays the carriers directly

- Customers receive a self-bill for each Boost product that is generated automatically from the PlanSource system

Boost Carriers

Product

Frequently Asked Questions

What advantages can my company gain by utilizing PlanSource Boost carrier integrations?

Through the use of carrier integrations, HR teams can now provide their employees with a modern and streamlined benefits engagement and administration platform that saves time and enhances the employee experience. These integrations are purposefully designed to cater to the unique needs of HR teams, either by improving operational efficiency or by delivering a superior employee experience. PlanSource Boost’s carrier integrations can lead to time savings, increased accuracy, and a more streamlined benefits management process for your organization. Thanks to these advancements in technology, HR teams can now use the time savings to focus on other strategic initiatives.

In what ways do the carrier integrations and other value-added features of PlanSource Boost enhance and modernize the overall employee shopping experience?

We are partnering with leading insurance carriers to breathe new life into the benefits industry with real-time API integrations, an engaging employee shopping experience and time-saving services. PlanSource offers an intuitive and easy-to-use shopping experience that is comparable to other online interactions. At time of enrollment, employees are served meaningful content to learn about their benefits—where they want to read it, how they want to read it and what they want to read. We offer personalized content and intelligent plan recommendations. This streamlined approach increases employees' confidence and understanding of their plans.

How much time can be saved by using simplified self-billing and how does it streamline the process for an HR team?

PlanSource Boost simplifies the billing process for HR teams, saving them over a week's worth of work each month. PlanSource services as the record-keeper for enrollment and billing, generating auto-invoices for each insurance carrier's products. Customers pay PlanSource, who then remits payment to the insurance carrier. PlanSource takes on answering all billing questions so that HR teams can focus on more important tasks.