with Lots of Benefits

Benefit Accounts Product Details

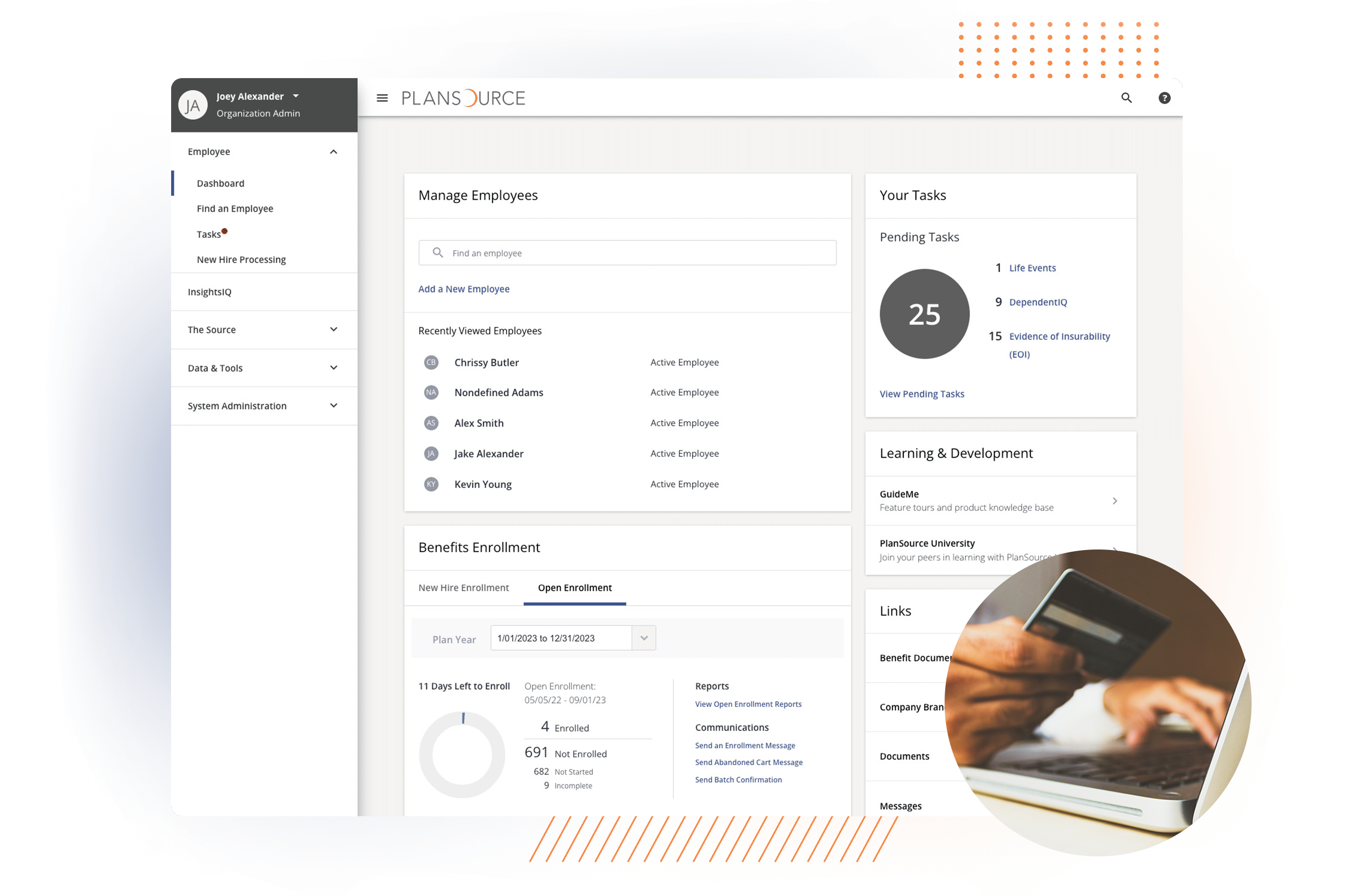

Open Enrollment Planning Playbook

On-Demand Webinar

Stay Focused

Improve Data Accuracy

Enhanced Experiences

Increased Control

Competitive Benefits

Payroll Tax Savings

Online Reimbursement

Online Account Management

Mobile App

Contact Center Assistance

Benefit MasterCards

Dependent MasterCards

Educational Tools

Online FSA/HSA Store

Get answers to questions about reimbursements, card status, etc.