Top 4 Dependent Verification Misconceptions

Dependent eligibility verification has a lot of benefits. It reduces unnecessary costs, saves HR time and effort, and reduces your company’s stop-loss exposure and litigation risks related to ERISA, Sarbanes-Oxley and other regulations. So why aren’t more companies doing this?

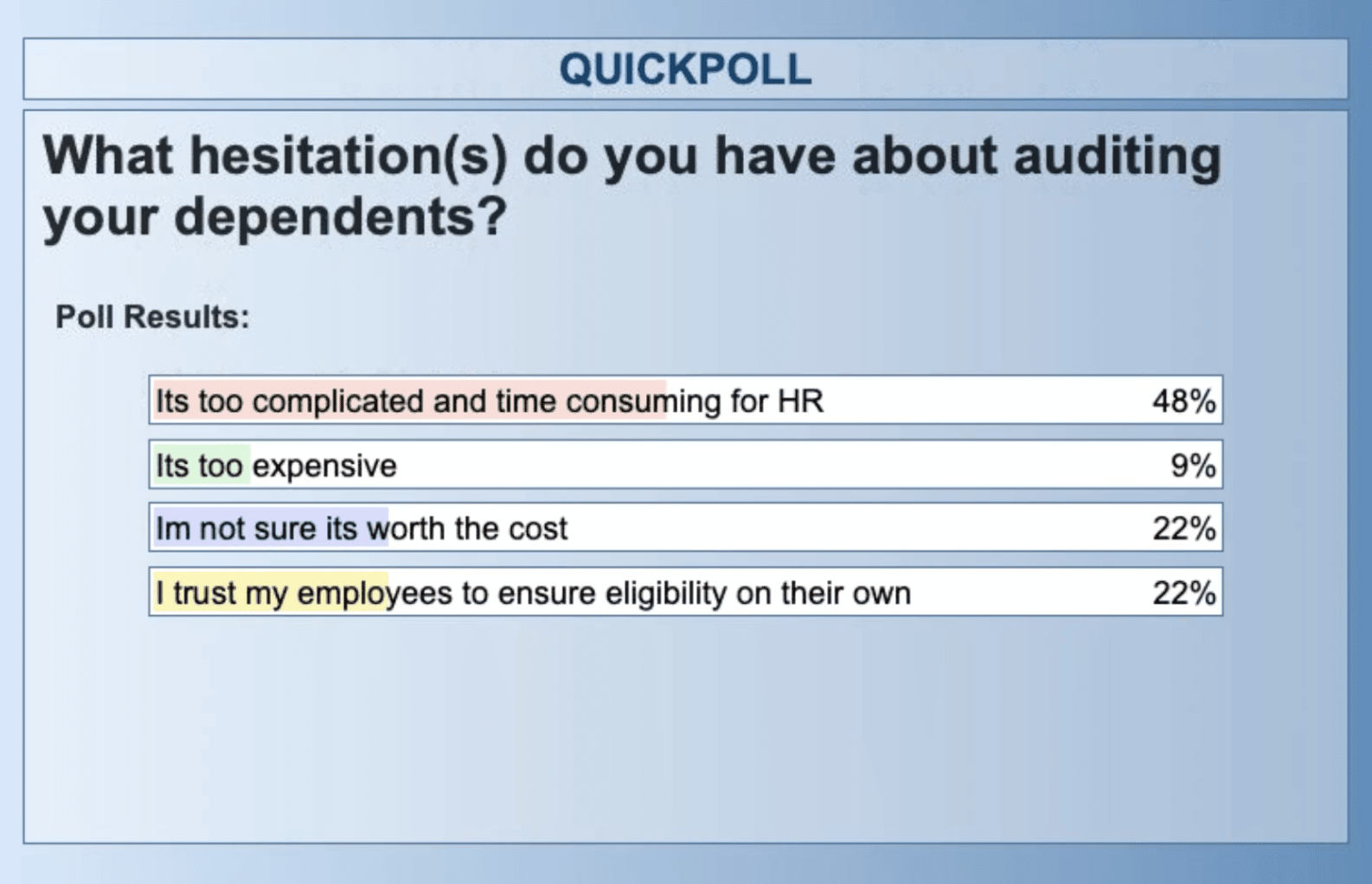

There are a lot of misconceptions surrounding dependent verification. In a recent webinar, we asked attendees about why they aren’t auditing their dependents.

The top answers included it’s too time consuming for HR, it’s not worth the cost and they trust their employees to ensure eligibility on their own. We want to break down these top misconceptions and explain how dependent verification, when powered by verification tools, should be a best practice for all HR teams.

1. It’s Too Complicated and Time Consuming For HR

Dependent verification is a very tedious process. To identify ineligible dependents and prevent new ones from occurring, you must conduct both initial and ongoing audits. Not only does this mean collecting documentation on and reviewing all existing dependents, but requiring and evaluating documentation on an ongoing basis as new dependents come in.

However, outsourcing simplifies this for HR. Talk to your broker or ben admin provider to see what services and tools they have available. Best-in-class providers typically offer verification services to conduct initial audits as well as tools, like DependentIQ , that automate and streamline ongoing auditing.

2. It’s Too Expensive

It’s no secret that outsourcing dependent verification or implementing an automation tool will come with additional costs on the front end. However, covering ineligible dependents is expensive too. By auditing your dependents, you can save an average of $3,500 per ineligible dependent removed. Additionally, while tools such as DependentIQ might seem too expensive, the average 3-year ROI is 17 times that initial cost.

3. I’m Not Sure It’s Worth the Cost

While the stats that we mentioned above are impressive, it makes sense to want to visualize your ROI for yourself. That’s why we’ve designed an ROI dashboard for DependentIQ to show how the product is being used and how it’s benefiting your company. This way, you can see just how much time and money you are saving in real-time while enjoying automated dependent verification.

4. I Trust My Employees to Ensure Eligibility on Their Own

It makes sense to trust your employees, and most wouldn’t intentionally add an ineligible dependent to their plan. However, mistakes happen and when they do, those employees are inadvertently committing insurance fraud.

We’ve talked about all the reasons dependent verification is beneficial to employers, but it also protects your employees. Additionally, it prevents sticky situations where an employee expects coverage for their dependent only to find out they are ineligible and aren’t actually covered.

Want to Learn More?

Watch our on-demand webinar to learn more about dependent verification, common misconceptions and the difference between initial and ongoing audits. Additionally, schedule a product demo with our team and see DependentIQ in action!

Empathy, Innovation & Action: Top Takeaways from HR Leaders Who Spoke at Eclipse

Empathy, Innovation & Action:Top Takeaways from the HR Leaders Who Spoke at...

Charting the Future of PlanSource: Our Vision for What’s Ahead

Discover how PlanSource unveiled game-changing AI innovations at Eclipse 2025, transforming how HR leaders manage benefits and how employees choose them. The future of benefits starts here.

Navigating New Requirements with the Paperwork Burden Reduction Act

Navigating New Requirements with the Paperwork Burden Reduction...