Webinar Recap: How to Increase Voluntary Plan Participation this OE

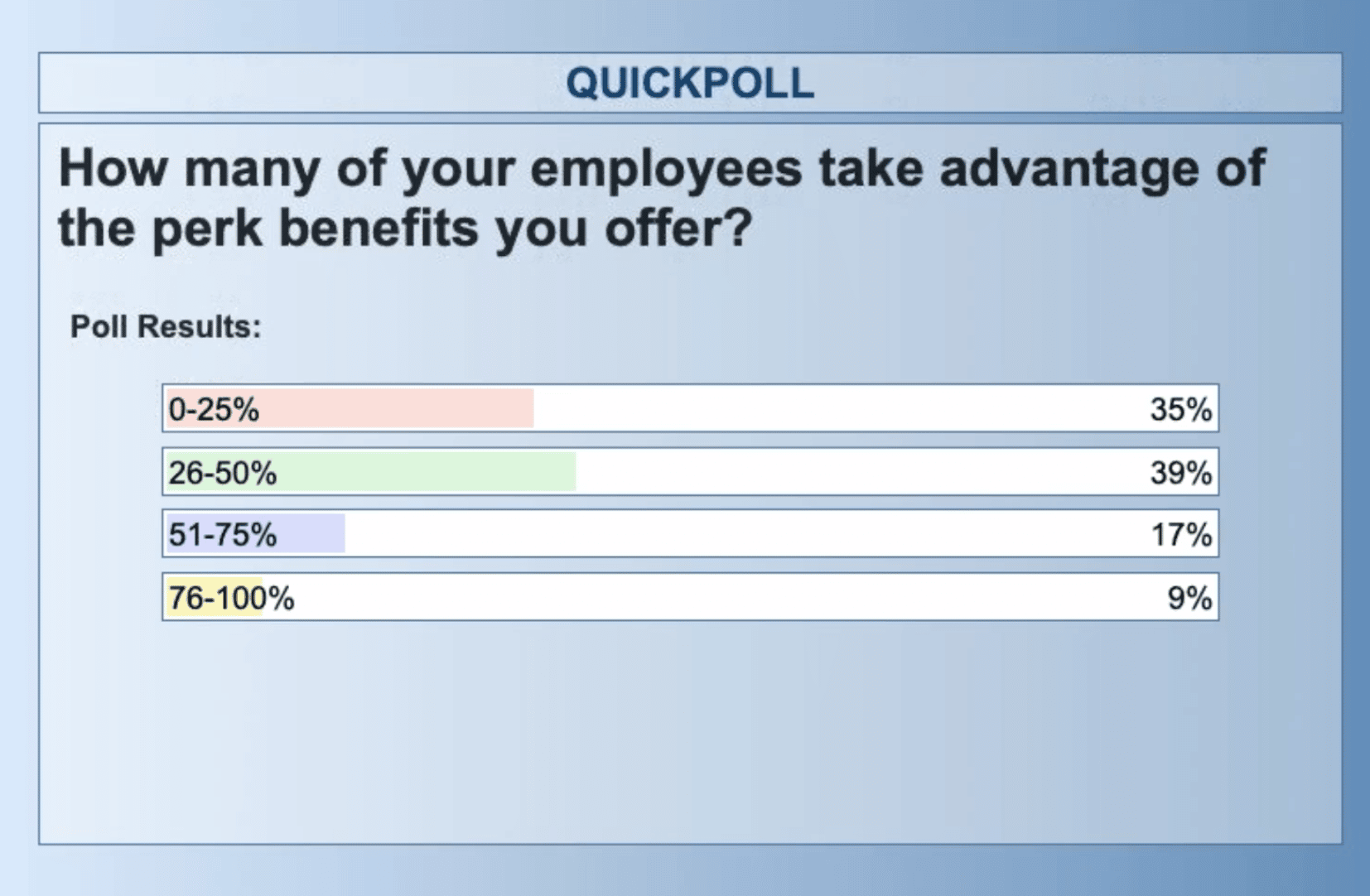

Voluntary plans are important to employees, and many HR teams have heard them loud and clear. In fact, 94% of large employers believe voluntary benefits will be more important to their total rewards strategy going forward. So how come majority of our webinar attendees report less than half of their employees are taking advantage of these offerings?

We sat down with PlanSource’s own Brantley Saunders and Darren Lucas, as well as Ron Cornwell from Milliman to discuss the importance of data-driven decision support tools and how they can promote voluntary benefit participation.

The Benefits Hierarchy

Voluntary benefits are key to attracting and retaining talent. As Brantley explains, these benefits “bolster employee loyalty, create excitement around employment and increase overall satisfaction.” In fact, employers offered an average of 17 benefits to their employees – up 9% from 2020. However, offering these benefits isn’t enough to ensure participation.

Brantley explains that the challenge employers now face is “making sure that their employees are comfortable signing up for these benefits that are going to require a portion of their paycheck.” As shown in the poll above, 74% of attendees said less than half of their employees actually enroll in the perk benefits they offer.

Although employees want to partake in these benefits, when enrollment comes around, they often can’t justify the cost in addition to the premiums they are already paying core benefits like medical, dental and vision. Employees often view benefits as a hierarchy – they consider core benefits a must, followed by traditional voluntary benefits, and then perk benefits are seen as a nice-to-have. So, if those first two tiers absorb too much of their benefits budget, employees won’t opt in for more unique voluntary benefits even if they wish they could.

How Does Decision Support Help?

Decision support confidently provides recommendations to employees, so they can confidently make core benefit decisions that are right for them. Best-in-class decision support tools not only match employees with their best-fit plans but as a result also drives awareness, increases understanding and lowers plan and premium costs – leaving more money left over to put toward voluntary benefits.

It’s important to note that not all decision support tools work the same way. There are two different models that work differently: individual claims model and aggregate claims model.

An individual claims model uses only the employee’s personal past benefit plan and spend data, adjusting for price inflation and chronic conditions, to provide recommendations. While on paper this sounds ideal since it’s hyper personalized, Brantley explains that individual claims are “time consuming and hard to pull in addition to being invasive to the employee.” Additionally, in a case where an employee spent more than they normally do in one year, their premiums will likely increase to reflect that for years to come.

On the other hand, the aggregate claims model provides recommendations based on a large dataset that matches the employee to others like them based on age, gender, location and more to determine a cost estimate. Employees can also personalize these recommendations further by providing information on any prescriptions or chronic conditions. This model is less invasive and results in better predictability by normalizing what an employee’s spend will be based on key demographic rather than reacting to one-off or emergency spend from previous years.

Who is Milliman and What is DecisionIQ?

At PlanSource, we’ve adopted the aggregate claims model into our own decisions support tool, DecisionIQ. But how do we access enough data to provide accurate matches and recommendations? That’s why we’ve partnered with the data experts at Milliman.

Milliman is among the world’s largest providers of actuarial services focused on insurance and healthcare and their utilization and claims cost data models are considered the gold standard in the industry. In fact, 90 of the 100 largest insurance carriers use Milliman to calculate their costs. Milliman’s dataset includes 100 million local cost benchmarks based on family demographics, plan design and expected utilization. That’s data on about 1 in 3 Americans. As Milliman’s own Ron Cornwell explains, “Data is at the core of what we do. With more information, we can make better decisions and that’s what we’ve done with DecisionIQ.”

Want to Learn More?

Watch our on-demand webinar for a Q&A with Ron Cornwell from Milliman and to learn what else DecisionIQ can do in Darren’s product demo. Additionally, to learn more about the rest of our IQ Suite, check out our InsightsIQ webinar and DependentIQ webinar.

Empathy, Innovation & Action: Top Takeaways from HR Leaders Who Spoke at Eclipse

Empathy, Innovation & Action:Top Takeaways from the HR Leaders Who Spoke at...

Charting the Future of PlanSource: Our Vision for What’s Ahead

Discover how PlanSource unveiled game-changing AI innovations at Eclipse 2025, transforming how HR leaders manage benefits and how employees choose them. The future of benefits starts here.

Navigating New Requirements with the Paperwork Burden Reduction Act

Navigating New Requirements with the Paperwork Burden Reduction...