What is Benefits Outsourcing and Is It Right for You?

Outsourcing — the practice of contracting out tasks or processes to external service providers — can be a game-changer for businesses of all sizes and across industries, especially those looking to streamline their operations and processes. Human resources is no exception.

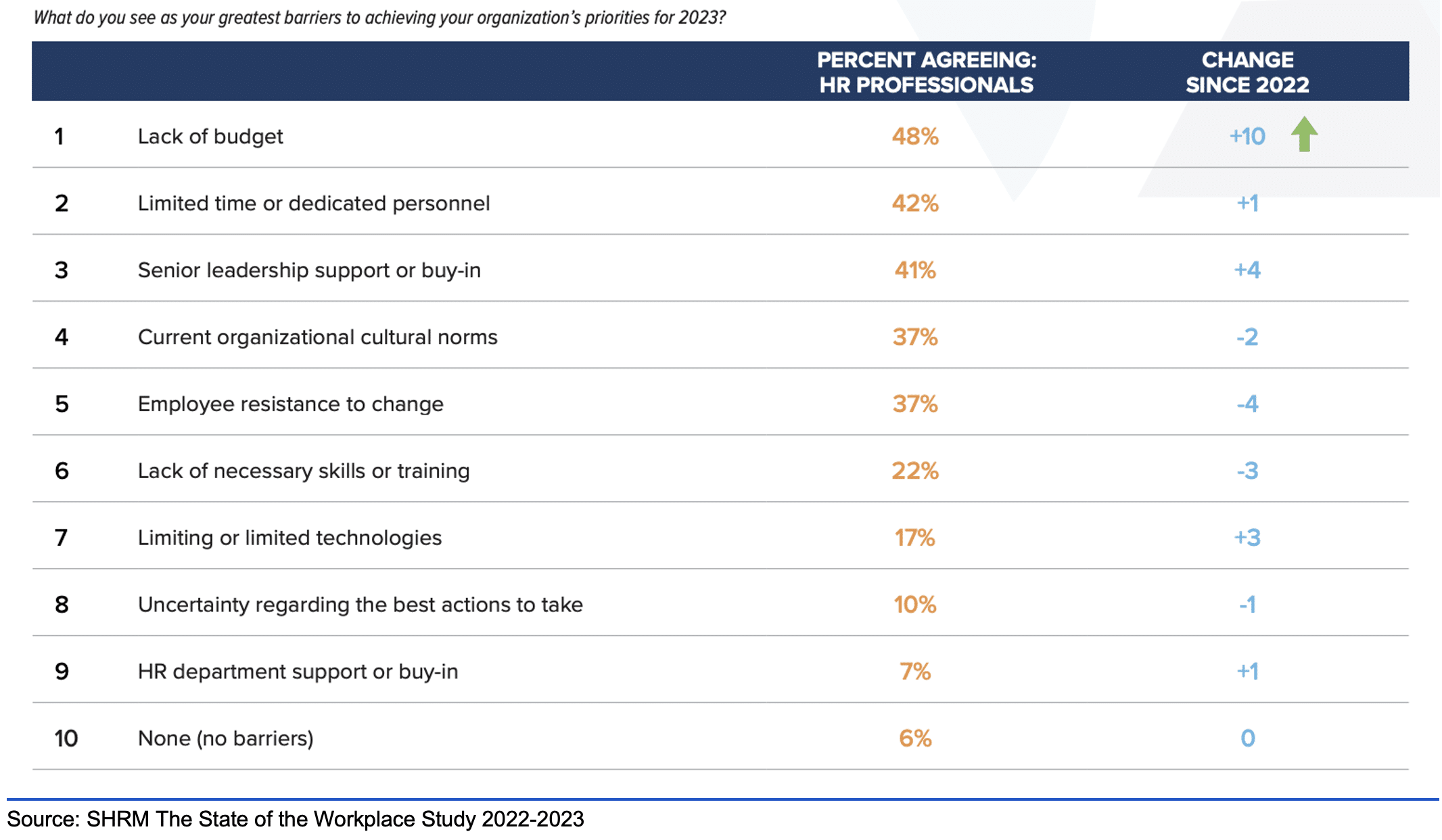

According to The Society for Human Resource Management (SHRM)’s 2022-2023 State of the Workplace Study, 70% of HR professionals feel that they are overloaded and working either too long or too hard. Further, 61% of HR professionals surveyed said that there are not enough staff for the workload.

When you consider the role HR plays in an organization’s ability to retain and attract top talent in an already tight labor market, it’s not surprising that companies that lack the necessary resources (typically, staff and technology) are leaning on employee benefits outsourcing. Without that assistance, functions critical to the company’s longevity would fall by the wayside.

Keep reading as we define what benefits outsourcing is, the reasons why businesses opt for it and what benefits are ideal for outsourcing.

Benefits outsourcing defined

Benefits outsourcing is the process of transferring responsibility for benefits administration to a third-party provider. This can range from fully outsourcing all aspects of benefits administration and management, such as payroll, COBRA administration and claims processing, to outsourcing pieces of it, including employee recruitment, open enrollment, communication and compliance.

Some employers opt to contract out only specific services within their existing benefits package, such as employee wellness programs or financial planning assistance.

Another major reason for outsourcing benefits is to reduce the burden of HR teams that are consistently asked to do more with less. As evidenced by the latest research below, HR teams are often understaffed and overworked relative to their role and impact to an organization. Outsourcing employee benefits administration tasks allows your team to focus on more strategic priorities.

Benefits management can be a complicated and time-consuming task that competes with other strategic HR functions. Besides giving HR staff more time to focus on your business, outsourcing employee benefits can:

- Control risk and help adhere to strict compliance regulations, including internal policies and procedures.

- Give access to external HR experts who specialize in managing employee benefits and procedures. Your organization benefits from their knowledge and expertise, reducing the risk of errors that might occur when the in-house HR team is spread too thin.

- Increase employee satisfaction with personalized enrollment guidance and faster response times to benefits questions. This is particularly beneficial for growing companies, companies with many employees and those with complex benefit offerings.

- Cut costs and lower your expenses. Employers that outsourced some of their HR tasks report as much as 40% cost savings compared to handling them in-house.

- Expand access to more options and broader resources for designing a benefits program that meets the needs of your organization. Some providers also have marketplaces of vetted ‘partners’ who offer value-added products to employees.

- Offer liability protection as the third-party provider takes on the responsibility (and liability) for ensuring compliance with all legal and regulatory requirements, which can be a potential source of risk for in-house benefits management.

As businesses grow, so do their administrative tasks, and HR teams are often responsible for handling these tasks.

Some of these responsibilities include managing employee benefits such as health insurance, the enrollment process and the communication process. However, your HR staff’s time might be better spent on more high-value, strategic responsibilities. With that in mind, here are some benefits that can be outsourced:

- Benefits process which entails managing and administering employee benefits such as health, dental, and vision insurance plans.

- Business processes such as payroll, timekeeping, leave of absence billing, retiree billing, dependent verification, and employee communications are also commonly outsourced as a way to improve operational efficiency.

- Quality assurance is another area that can be outsourced to ensure high-level deliverables and reduce errors. This can include reviewing and processing employee claims and ensuring compliance with regulations.

- Other common benefits that are often outsourced include COBRA and HSA/FSA/HRA administration, retirement plans, disability insurance, life insurance, workers’ compensation, leave programs, dependent care plans and other perks such as gym memberships.

By outsourcing these types of benefits, employers can take advantage of lower costs and improved services while avoiding the need for added in-house staff and resources. Outsourcing also lets the business remain agile — you can quickly adapt to changes in regulations or business needs without having to worry about the impact on your internal operations.

Want to learn more about employee benefits outsourcing? Take a look at the services we offer.

Streamlining Multi-Carrier Benefits Billing with PlanSource

Streamlining Multi-Carrier Benefits Billing with PlanSource [rt_reading_time...

PlanSource Unveils New Capabilities and Enhancements

PlanSource Unveils New Capabilities and Enhancements [rt_reading_time...

Aligning Employee Benefits with Corporate Culture

Aligning Employee Benefits with Corporate Culture [rt_reading_time...