Top 10 Questions about the American Rescue Plan Act (ARPA)

Since March 11, 2021 the American Rescue Plan Act (ARPA) has introduced thousands of questions from employers racing against the bill’s tight deadlines to stay legally compliant. Who is eligible for the subsidy? How do employers implement the plan? Who’s paying for it? All of these questions can be answered in our recent blog detailing the scope of the bill, but some questions need a bit more investigation to answer.

In our most recent COBRA/ARPA webinar that was full of compliance information, our attendees asked some great questions so we compiled them in an easy to read ‘Top 10 List’ for you! However, if you have specific questions and are already a PlanSource customer, please reach out to your Customer Success contact or email us at cobra.arpa@plansource.com

Let’s get to the ARPA questions employers are asking:

1. What is PlanSource doing for customers?

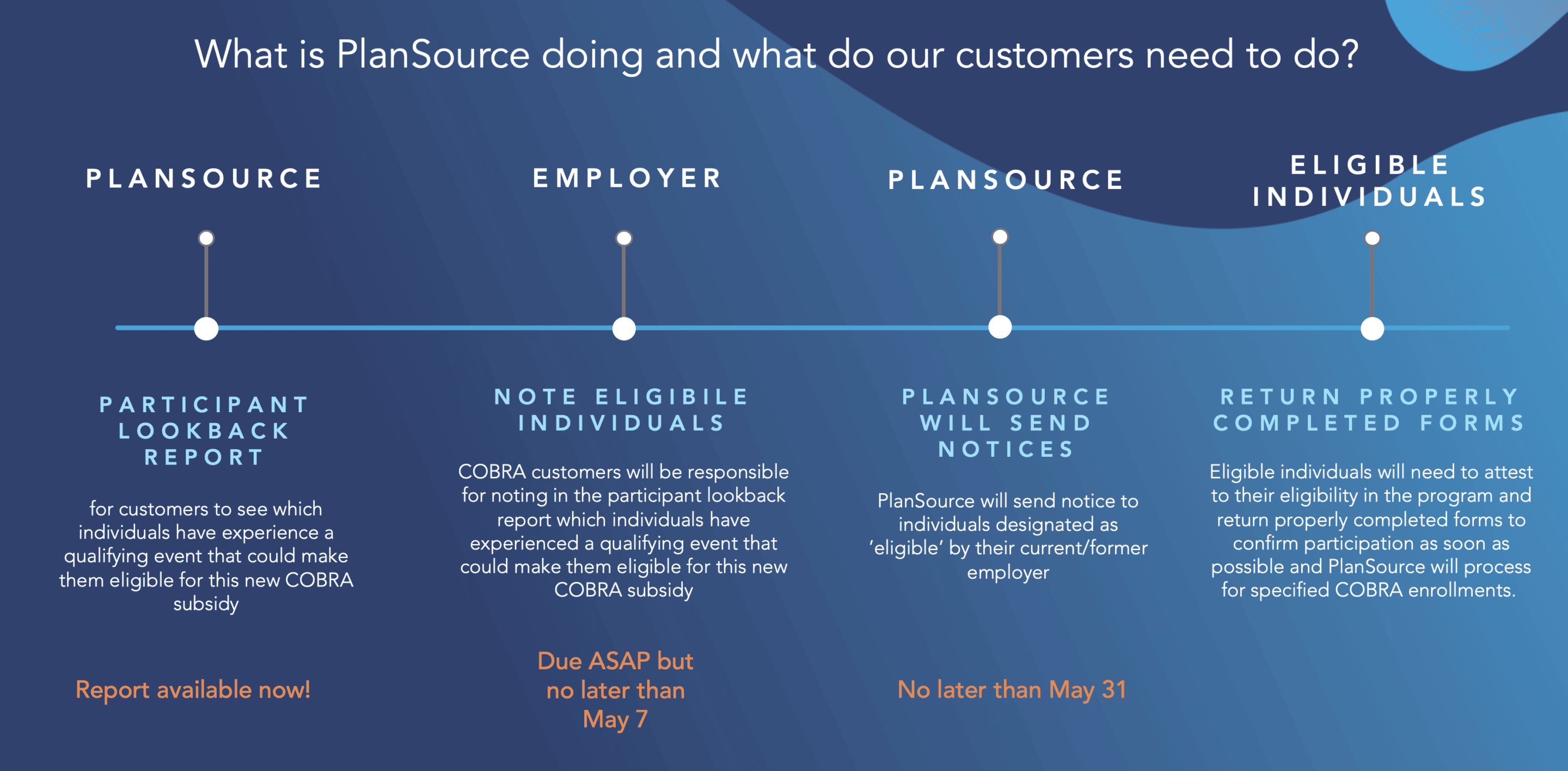

We’re working closely with our partners to make sure we’re appropriately tracking this new law as it develops, so our customers are taken care of. Though it’s evolving continually, below is our current timeline as dictated by the Department of Labor (DOL). The next major date to be on the lookout for is May 31, 2021 when all subsidy notifications must be mailed by PlanSource.

Many of our clients have also asked how the subsidy and fees will work as well. ARPA subsidies and administration fees will be referenced in the monthly remittance report our customers receive. A separate report relating to the credits offered from this law will be available when requesting the Payroll Tax Credit from the IRS.

2. If we just switched to PlanSource as our COBRA administrator, will PlanSource work with our previous admin to facilitate the ARPA subsidy?

Great question. We plan to work directly with our clients to address these legacy individuals and make sure they’re taken care of, but we will not be working directly with prior administrators.

3. How do we determine who is potentially eligible for this subsidy and how do we update this status in thePlanSource Platform?

In order to examine potential eligibility you will need the ‘QB AEI 2021 report’ (also known as the participant lookback report) and the ‘AEI 2021 Status’ utility. Watch this quick video to learn how to access the report and fill it out.

4. Can the required notices be sent via email considering much of the workforce is still remote?

Yes, but it’s definitely not a best practice we’d advise. While it may be possible to send notices via email (as long as the DOL’s electronic disclosure rules are satisfied), the recommended method of sending legal disclosures is to do so via first-class mail to the individual’s last known address.

5. Are voluntary benefits plans, like Critical Illness Insurance, Accident Insurance and similar plans, eligible for this subsidy if they are eligible for COBRA?

Based on the guidance from the Department of Labor, if a group health plan is subject to COBRA laws it will also be subject for this subsidy. The major exception to this are Health FSA’s which are explicitly excluded from this law.

6. The CARES Act extended some HIPAA special enrollment rights. Would a spouse eligible under this extensionbe eligible for the ARPA subsidy?

As long as the individual does not otherwise have the right to seek enrollment due to a loss of coverage resulting from involuntary termination or reduction of hours, the HIPAA special enrollment would not provide eligibility for the COBRA subsidy.

7. Does the death of an employee cause the surviving spouse to be eligible?

Unfortunately not. This law considers death as a voluntary termination in relation to COBRA and this subsidy, and voluntary terminations make individuals and their dependents ineligible.

8. If an employee was terminated for violating company policy or failing to meet job performance requirements, are they still eligible for the ARPA subsidy?

Yes, despite the reasons for leaving your company, if an employee is involuntarily terminated they are eligible for assistance under this law. There may be exceptions for examples of gross misconduct, consult your trusted legal counsel if you have questions here.

9. If an intern completes their temporary assignment at our company, are they then eligible for the subsidy?

If the intern has group health coverage and the employer terminates the intern’s employment due to the end of the assignment, then yes, the intern would be eligible for the COBRA subsidy.

10. If an employer is exempt from ERISA and COBRA, such as a church, but their plan allows continuation of benefits similar to COBRA, would they be eligible to this ARPA subsidy and get tax credits?

The IRS has not provided official guidance on matters like this. However, if the employer is not subject to Federal COBRA or State continuation coverage, but provides “COBRA-like” continuation coverage as a matter of the specificplan’s design, it would likely not be eligible for the COBRA subsidy and tax credits. (More information is needed from the IRS to be absolutely positive on this though)

We know you might have more questions and we will continue to provide updates as we find out more information. If you’re looking for information regarding ARPA on a more general level than you found here, be sure to visit our informational blog that we’re updating as more information becomes available and check out the replay by streaming our on-demand webinar. And remember, if you have specific questions and are a PlanSource customer you can reach out directly to your Customer Success contact or email us here: cobra.arpa@plansource.com We’re here to help!

The information contained in this site is provided for informational purposes only and should not be construed as legal or professional advice on any subject matter.

You should not act or refrain from acting based on any content included in this site without seeking legal or other professional advice. The contents of this site contain general information and may not reflect current legal developments or address your situation. PlanSource disclaims all liability for actions you take or fail to take based on any content on this site.

Celebrating Women’s History Month

Celebrating Women's History MonthReflecting on Progress and Aspiring for...

Reseller Spotlight: H2H Enrollments

Reseller Spotlight: H2H Enrollments [rt_reading_time label="Read Time:"...

Uniting Against Cancer

Uniting Against CancerUnderstanding National Cancer Prevention...